Outside of the U.S., locational marginal pricing has been used in New Zealand for more than 20 years, and versions of locational pricing have been used in Chile and Norway for many years. Locational Marginal Price or “LMP” shall mean the market price for energy at a given location in a Party’s Control Area, calculated in accordance with the requirements of the Party’s tariff, and “Locational Marginal Pricing” shall mean the processes related to the determination of the LMP. Sample 1 Sample 2 Sample 3. Locational Marginal Pricing (LMP) Request A Demo. Chat With An Expert. LMP Node Search, Map, Compare ️. Search through LMP data by ISO, state, hub, zone, or node. Easily find nodes based on pricing characteristics (average, min.

Locational Marginal Pricing (LMP), Price Formation and Competitive Electricity Markets. All centrally coordinated electricity markets in the U.S. Currently employ locational pricing to price electric energy. PJM implementation: April 1, 1998; New York ISO implementation: November 19, 1999; ISO New England implementation March 1, 2003. Locational Marginal Pricing (LMP) Request A Demo. Chat With An Expert. LMP Node Search, Map, Compare ️.

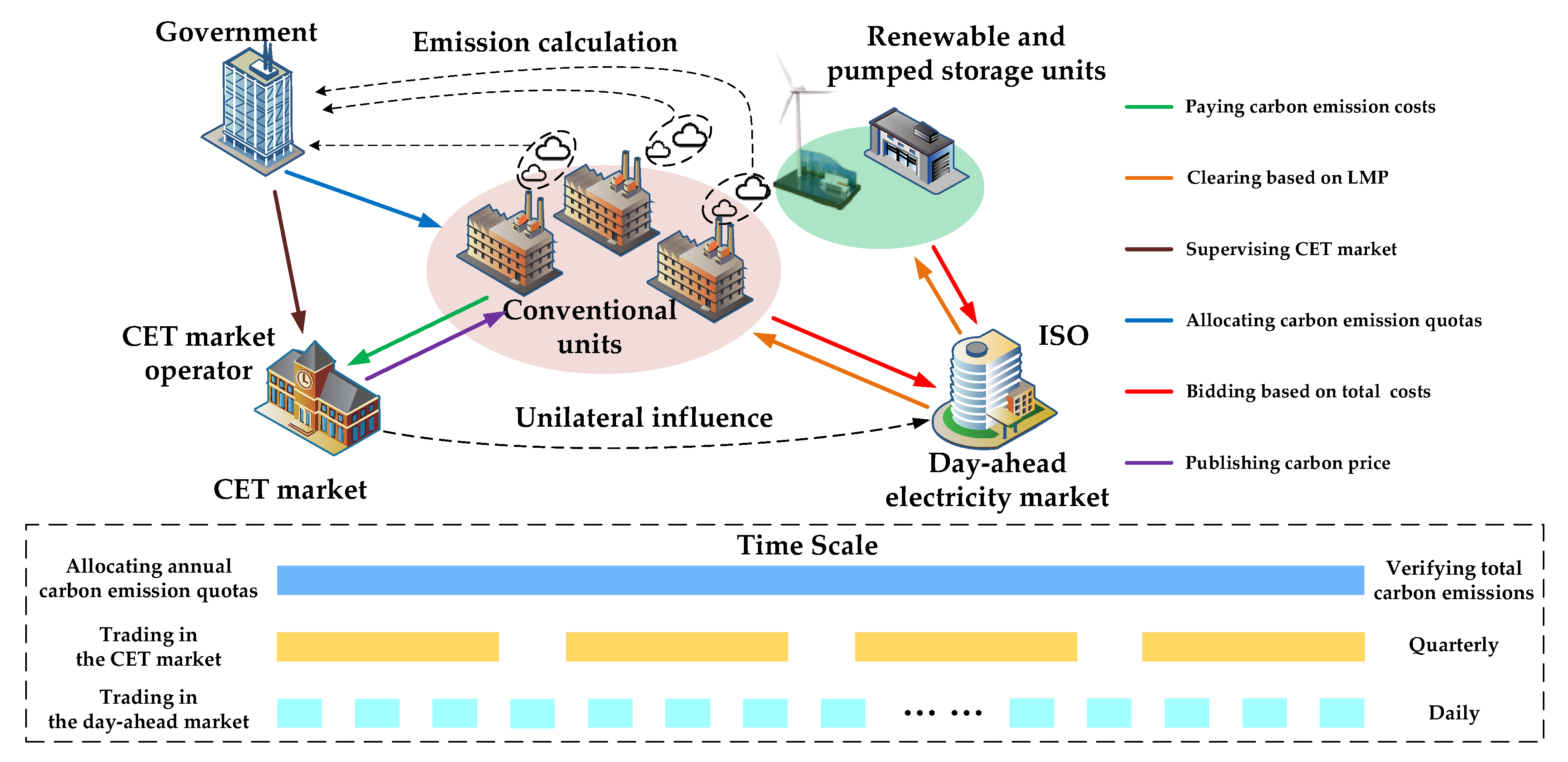

PrintIn the first part of this week's lesson we learned how the uniform price auction works: Generators submit supply offers; the RTO aggregates those supply offers to form a system supply curve or 'dispatch curve;' and the market clears at the point where the dispatch curve intersects the (fixed) level of demand. Those generators with supply offers below the market clearing point are dispatched while those with supply offers above the market clearing point are not dispatched.

In the absence of any transmission congestion, every generator clearing the market would get paid the SMP. This is why low cost generators, which we call 'inframarginal suppliers,' can be very profitable under the uniform price auction. You might also have noticed that the marginal generator earns no profit under the uniform price auction. We'll come back to this point later in the course.

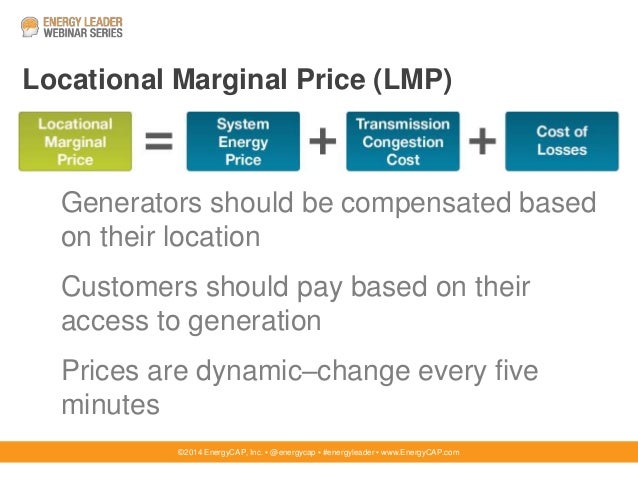

When there is transmission congestion, however, things get more complicated because the transmission congestion segments the market. Some areas of the market are on one side of the constraint and some areas are on the other side of the constraint and no further deliveries can take place between the two areas. It's as if someone has just built a big wall between the two sides of the market. If demand increases on one side of the constraint, a generator on that side of the constraint has to be dispatched to meet that demand. If demand increases on the other side of the constraint a different generator on that side of the constraint has to be dispatched. These generators may have different costs and supply offers, and thus the marginal cost of meeting demand in one location is different from the marginal cost of meeting demand in another location. These location-specific costs are called Locational Marginal Prices.

The formal definition is that the Locational Marginal Price (LMP) at some node k in the network is the marginal cost to the RTO of delivering an additional unit of energy to node k.

Relatedly, we sometimes define the 'transmission price' or 'congestion cost' between two nodes j and k in the network as the difference in LMPs between the two nodes.

The LMP forms the basis for payments to generators and payments by buyers in the PJM electricity market and other such markets in the US. Generators are paid the LMP at their node for electric energy produced, and buyers pay the LMP at their node for electric energy consumed. The RTO acts as the middleman for all purchases and sales, so it collects money from buyers and pays money to sellers. We'll come back to this important point later in the lesson.

Here are a few facts about Locational Marginal Prices:

- Fact #1:

If there is no transmission congestion in the network, then LMPs at all nodes are equal, and will be equal to the System Marginal Price. This says that if no transmission lines are constrained, then the same marginal generator could be used to serve an additional unit of electric energy demand anywhere in the network. - Fact #2:

A high LMP at some node (relative to other nodes) says that it is expensive to deliver electric energy to that location. It does not necessarily mean that a transmission line connected to that node is congested. (The bottleneck may be elsewhere in the system.) - Fact #3:

If we observe that the LMP at node j is higher than the LMP at node k, this does not necessarily mean that electricity is flowing from node k towards node j. This is an odd economic result, which is pretty unique among commodity markets. It says that electricity can move from a high priced location towards a low priced location. Normally we think that commodities should move in the opposite direction - from low priced locations to high priced locations. This is often the case with electricity, although sometimes because of the physics of power flow we can observe this economically counterintuitive result. - Fact #4:

LMPs can be negative. This is another odd economic result. It says that negative prices in electricity markets can be perfectly natural. In fact, they happen very frequently. In such circumstances generators would have to pay the RTO to sell electricity and buyers would get paid to consume electricity. Negative prices can arise because generators may not have the operational flexibility to respond to quickly-changing system conditions. Suppose that electricity demand in some area suddenly declined by a large amount. The generator serving that demand cannot respond quickly enough. It could shut itself off, but with a cost. In this situation the LMP may become negative, signaling to the market that balancing supply and demand by reducing supply (turning off the generator) would be costly. Demand and supply could instead be balanced by increasing consumption, which would actually save costs for the generator. We often observe negative prices when there are surges of wind or solar power in a given region, because these surges effectively flood the electric grid with very, very cheap electricity (remember, the marginal cost of wind and solar is basically zero).

While we will demonstrate LMP on small networks, real power grids are very large. PJM, for example, calculates LMPs on over 40,000 different locations every five minutes.

Locational Marginal Prices

LMPs can be highly variable across different parts of an RTO territory and can be very volatile depending on system conditions. The figure below shows a heat map of LMPs in the PJM system on a warm, but not terribly hot, summer day. The areas in blue (in the western part of the PJM territory) have very low LMPs, indicating that there is a lot of low-cost generation capacity in those regions to meet demand. The areas in yellow and red exhibit higher LMPs, while the area around Washington, DC has the highest LMPs (in white). Why does this happen? The answer is that there are transmission constraints in the PJM network that limit the amount of low-cost generation in places like Ohio that can be used to meet high electricity demand in places like Washington, DC. There is plenty of generation but not enough transmission to move the power around. So to meet electricity demand in Washington, DC, PJM must use higher-cost generators that are located closer to Washington, DC.